ETH Price Prediction: Analyzing the Path to $5,000 Amid Bullish Technicals and Strong Fundamentals

#ETH

- ETH trades above key moving average with strong technical momentum

- Positive ecosystem developments support fundamental growth thesis

- $4,700 resistance level crucial for path to $5,000 target

ETH Price Prediction

Technical Analysis: ETH Price Momentum Building Toward Key Resistance

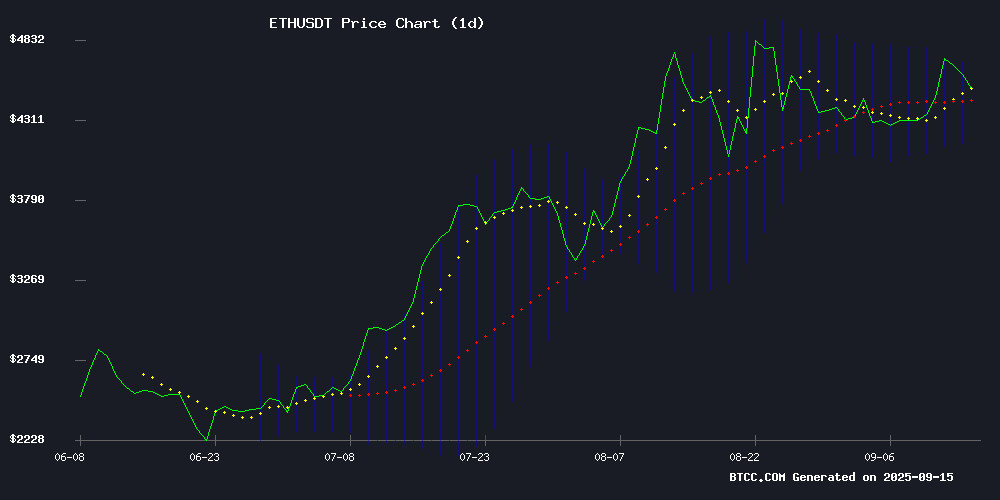

ETH is currently trading at $4,643.79, positioned above its 20-day moving average of $4,423.55, indicating sustained bullish momentum. The MACD reading of 11.98 versus its signal line at 73.92 shows some divergence, suggesting potential consolidation before further upward movement. Bollinger Bands analysis reveals price action NEAR the upper band at $4,694.41, which often acts as dynamic resistance. According to BTCC financial analyst Robert, 'The technical setup supports a gradual ascent toward the $5,000 level, though traders should monitor the $4,700 zone for potential short-term resistance.'

Market Sentiment: Positive Fundamentals Support ETH's Growth Trajectory

Current market sentiment remains optimistic as ethereum demonstrates strong institutional adoption and technological advancements. News of Wall Street embracing tokenization and major developments like MegaETH's USDm stablecoin launch highlight growing ecosystem maturity. However, concerns about supply chain attacks and AI governance warnings introduce elements of caution. BTCC financial analyst Robert notes, 'While technicals show strength, the fundamental developments in Ethereum's ecosystem—particularly in layer-2 solutions and institutional adoption—provide compelling reasons for sustained upward momentum toward the $5,000 threshold.'

Factors Influencing ETH's Price

Ethereum’s Growth Story: Trillion-Dollar Value and Developer Paradox

Ethereum continues to dominate as the world’s second-largest blockchain, securing over $1 trillion in value and serving as the backbone for thousands of decentralized applications. Despite its towering valuation, a stark paradox emerges: Ethereum’s developers earn significantly less than their counterparts in traditional tech sectors. Median salaries hover around $140,000, dwarfed by external offers ranging from $300,000 to $700,000.

Protocol Guild data reveals only 37% of Ethereum developers receive token allocations, compared to an industry average of 6.5%. This disparity raises concerns about retention and brain drain, threatening Ethereum’s innovation pipeline just as its role in global finance expands.

Meanwhile, retail investors flock to high-risk, high-reward projects like BullZilla ($BZIL), which has already raised $400,000 and attracted 1,400 holders. The contrast between Ethereum’s institutional heft and retail speculation underscores the evolving dynamics of crypto markets.

BullZilla Presale Surges Past $370k as Ethereum and World Liberty Financial Gain Traction

Three projects are capturing attention in the 2025 market cycle: BullZilla, Ethereum, and World Liberty Financial. BullZilla, a meme coin with cinematic lore and advanced tokenomics, has raised over $370k in its presale, offering early investors an 800% ROI. Ethereum continues to dominate smart contract platforms, while World Liberty Financial aims to reshape global finance through blockchain.

BullZilla's unique proposition lies in its 24-chapter mythology and token mechanics designed for burns and rewards. Currently priced at $0.00005241 in Phase 2D of its presale, the token's projected listing price of $0.00527 suggests a potential 9,958% upside. Over 1,300 holders have already participated, signaling strong community interest.

Vitalik Buterin Warns Against Naive AI Governance Models

Ethereum co-founder Vitalik Buterin has issued a stark warning about the vulnerabilities of simplistic AI governance frameworks. In a recent post on X, Buterin argued that unchecked AI systems could be easily exploited through techniques like jailbreaking, where malicious actors manipulate prompts to bypass safeguards.

Buterin advocates for an "info finance" model that incorporates open markets, spot checks, and human oversight. His proposal ties governance to economic incentives, enabling faster error correction and real-time model diversity. Demonstrations of prompt injection attacks have shown the risks of granting AI systems unchecked authority over critical functions like funding allocation.

The Ethereum creator's critique highlights a growing tension in AI development between efficiency and security. His solution emphasizes resilient systems design over naive trust in algorithmic governance—a perspective informed by blockchain's decentralized philosophy.

Ethereum Foundation Prioritizes Privacy in New Blockchain Roadmap

The Ethereum Foundation has unveiled a strategic roadmap to embed privacy protections into the blockchain's architecture, rebranding its research arm as Privacy Stewards of Ethereum (PSE). The shift signals a move from theoretical exploration to practical implementation, aiming to safeguard users as Ethereum scales globally.

Sam Richards of PSE framed privacy as existential for Ethereum's ethos: without robust safeguards, the network risks becoming a surveillance tool rather than a platform for financial sovereignty. The roadmap targets three technical pillars—private writes, private reads, and private proving—to enable confidential transactions and data access without compromising decentralization.

Zero-knowledge proofs feature prominently in the plan, with optimization efforts focused on making the privacy-preserving technology viable for everyday use. The initiative comes as regulatory scrutiny of blockchain transparency intensifies worldwide.

Ethereum Price Near $4,356 as Bulls Eye Breakout Above $4,577

Ethereum trades at $4,356.94, up 1.53% in 24 hours despite a marginal weekly dip. Trading volume surged 70% to $33.94 billion as developers advance the Fusaka hard fork, targeting Q4 implementation with validator efficiency upgrades.

Historical precedent suggests bullish momentum—ETH rallied 32% post-Dencun upgrade. Futures open interest jumped 27%, signaling institutional and retail positioning for upside.

Network activity reinforces optimism: daily active addresses rebounded to 645k from August lows, while whale accumulation and constrained exchange inflows reduce sell pressure.

MegaETH and Ethena Launch USDm Stablecoin to Subsidize Ethereum Layer-2 Costs

MegaETH, an Ethereum layer-2 protocol, has partnered with Ethena to introduce USDm, a yield-bearing stablecoin backed by BlackRock's tokenized U.S. Treasury bills. The stablecoin's reserves will be directed into BlackRock's BUIDL fund, generating yield to subsidize sequencer operations on the MegaETH network.

This innovative model aims to reduce transaction fees by covering infrastructure costs through Treasury yields rather than traditional profit margins. Shuyao Kong, MegaETH co-founder, describes the approach as a "win-win scenario" for users and stakeholders, offering predictable low fees while maintaining network sustainability.

The integration of USDm into MegaETH's ecosystem represents a strategic shift in layer-2 economics, potentially setting a precedent for other scaling solutions. By leveraging institutional-grade yield products, the protocol creates a more stable foundation for fee reduction compared to volatile transaction-based models.

Malicious npm Packages Exploit Ethereum Smart Contracts in Supply Chain Attack

Cybercriminals deployed two malicious npm packages—colortoolsv2 and mimelib2—disguised as Ethereum blockchain smart contracts to infiltrate developer environments. Uploaded in July 2025, these packages leveraged Ethereum's decentralized infrastructure to conceal malware download URLs, a technique dubbed "EtherHiding." The attack bypassed traditional security scans by embedding obfuscated code that activated malicious smart contracts upon integration.

The campaign targeted GitHub repositories posing as trading bot projects, artificially inflating metrics via a fake network called Stargazers Ghost Network. While the rapid identification of vulnerabilities limited damage, the incident underscores the growing sophistication of supply chain attacks in crypto ecosystems. Developers are urged to scrutinize dependencies and audit third-party code rigorously.

Upbit Parent Dunamu Unveils Layer-2 Blockchain GIWA

Dunamu, the parent company of South Korea's leading cryptocurrency exchange Upbit, has launched GIWA, a new Web3 infrastructure brand. The announcement was made at the Upbit Developer Conference in Seoul, positioning GIWA as a tool to democratize blockchain access for developers and users globally.

GIWA Chain, a layer-2 solution built on Optimistic Rollup technology, is currently in testnet phase. The ecosystem also includes GIWA Wallet, a multi-chain mobile app supporting Ethereum, Base, Arbitrum, and other networks. Dunamu draws a cultural parallel between the blockchain's architecture and Korea's traditional giwa roof tiles—both designed for durability and scalability.

The move challenges the current dominance of U.S. and Singapore-based blockchain ecosystems. While no official launch date has been set for the wallet, its demo is available during the conference. This marks Dunamu's strategic push to onboard Korean developers into Web3 through localized infrastructure.

Wall Street Embraces Tokenization: The Next Big Wave for Cryptocurrencies

Nasdaq has taken a pivotal step toward integrating tokenized securities into traditional markets, filing an application with the SEC. Approval could enable trading of blockchain-based assets like Ethereum ($4,307) on major U.S. exchanges, marking a watershed moment for institutional crypto adoption.

The move follows heightened Wall Street interest in asset tokenization, now viewed as a credible trillion-dollar opportunity rather than speculative hype. Regulatory tailwinds from the Trump administration have accelerated financial giants' exploration of blockchain-based trading infrastructure.

Global liquidity pools may soon access tokenized real-world assets through regulated venues, with the SEC actively considering rule changes to accommodate crypto trading on national securities exchanges. This institutional momentum signals a maturation phase for digital assets beyond retail speculation.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH shows strong potential to reach $5,000. The price currently trades well above its 20-day moving average, and positive news around institutional adoption and layer-2 innovations supports continued growth. However, investors should remain aware of resistance near $4,700 and monitor broader market conditions.

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $4,643.79 | Bullish above MA |

| 20-Day MA | $4,423.55 | Support level |

| Bollinger Upper | $4,694.41 | Near-term resistance |

| MACD | 11.98 | Momentum building |